Rmd 2021 calculator

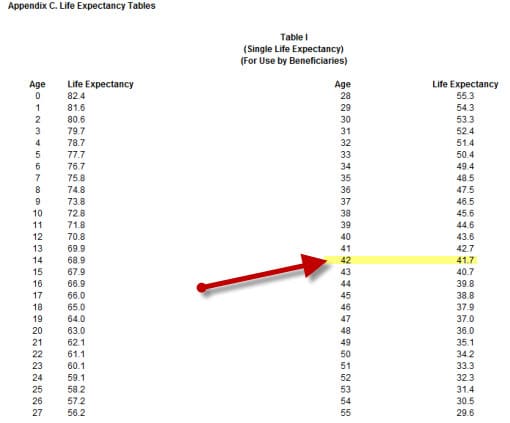

Use one of these worksheets to calculate your Required Minimum Distribution from your own IRAs including SEP IRAs and SIMPLE IRAs. Account balance as of December 31 2021 7000000 Life expectancy factor.

Rmd Tables

If you turned 72 prior to January 1 2022 you must take your 2022 RMD before December 31 2022.

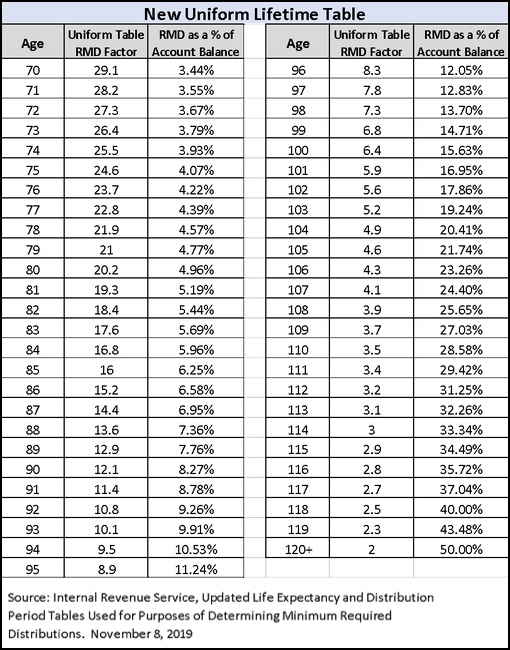

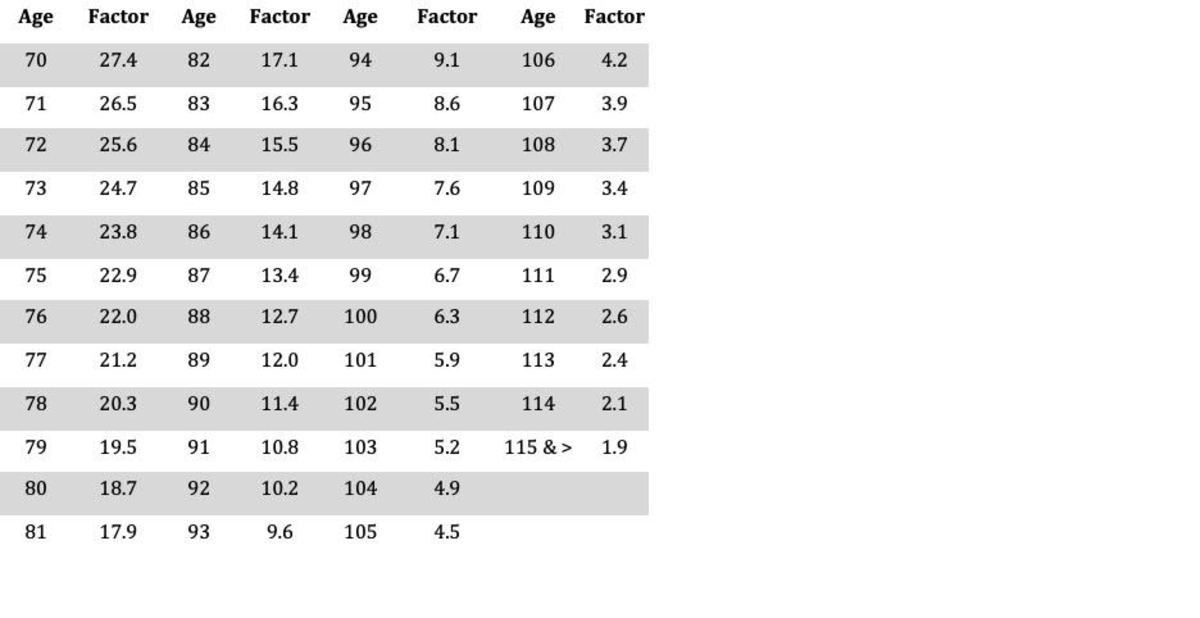

. How is my RMD calculated. Anybody can calculate their RMD by dividing the year-end value of the retirement account by the distribution period value that matches their age at the end of the year. Terms of the plan govern A plan may require you to.

If you were born on or after. Run the numbers to find out. The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from.

If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from. This calculator follows the SECURE Act of 2019 Required Minimum Distribution RMD rules. Calculate the required minimum distribution from an inherited IRA.

The SECURE Act of 2019 changed the age that RMDs must begin. This calculator follows the SECURE Act of 2019 Required Minimum Distribution RMD rules. IRA Required Minimum Distribution RMD Table for 2022.

RMDs are also waived for IRA owners who turned 70 12 in 2019 and were required to take an RMD by April 1 2020 and have not yet done so. This calculator has been updated for the. If you were born.

As a reminder if your first RMD was required in 2021 and you havent already taken it. Westend61 GettyImages. 0 Your life expectancy factor is taken from the IRS.

You must take your first RMD for 2021 by April 1 2022 with subsequent RMDs on December 31st annually thereafter. You can use Vanguards RMD Calculator to estimate your future required distributions when youre putting together your retirement income plan. If youve inherited an IRA depending on your beneficiary classification you may be required to take annual withdrawalsalso known as required.

The age for withdrawing from retirement accounts was increased in 2020 to 72 from 705. Calculate your required minimum distributions RMDs The RMD calculator makes it easy to determine your required minimum distribution from a Traditional IRA to avoid penalties and. Use this calculator to determine your Required Minimum Distribution RMD.

The SECURE Act of 2019 changed the age that RMDs must begin. If you are the original account owner your RMD is calculated by dividing prior year-end account balances by a life expectancy factor in the IRS Uniform Lifetime Table PDF. Therefore your first RMD.

New Tables Are Available For Calculating Required Minimum Distributions Rmds In 2022 Julie Jason

Rmd Tables

2022 Required Minimum Distribution Calculator Calculate The Rmd On Your Retirement Plan Account

Required Minimum Distribution Calculator

Knowledge Base Required Minimum Distributions Rmd S Help Center Financial Planning Software Rightcapital

Sjcomeup Com Rmd Distribution Table

New Guidelines For Your Required Minimum Distributions Rmd Coming In 2022 Paul R Ried Financial Group Llc

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Required Minimum Distribution Calculator Estimate Minimum Amount

Sjcomeup Com Rmd Distribution Table

Required Minimum Distribution Rules Sensible Money

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

10 Ira Minimum Distribution Calculator Templates In Pdf Free Premium Templates

How Recent Changes To Required Minimum Distribution Rules May Affect Future Value Tsp Accounts

Sjcomeup Com Rmd Distribution Table

Rmd Table Rules Requirements By Account Type

Rmd Table Rules Requirements By Account Type