Business vehicle depreciation calculator

D P - A. A P 1 - R100 n.

Macrs Depreciation Calculator Irs Publication 946

Instant Asset Write Off.

. Our car depreciation calculator helps you to calculate how much your car will be worth after a number of years. The 2017 Tax Cuts and Jobs Act made changes to extend and increase benefits to businesses for buying equipment machinery vehicles and other business property. Free MACRS depreciation calculator with schedules.

How to calculate the Section12C DepreciationWear and Tear allowance on plant and machinery used for manufacture s12c Wear Tear How to calculate the accelerated S12E DepreciationWear and Tear allowance on assets in a Small Business Corporation SBC. These benefits come from increased write-offs on your business tax return. You do this by including in income on Schedule C part of the deduction you took.

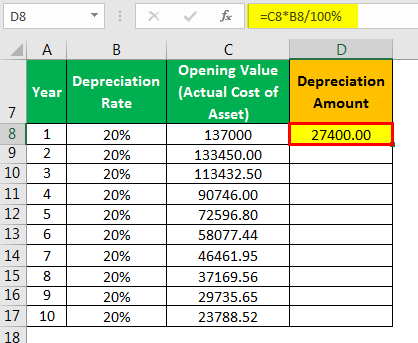

The average car depreciation rate is 14. Under the instant asset write off rule you can immediately claim a small business tax write off for the cost of the business-use portion of the vehicle in the same year that you first used it. Where A is the value of the car after n years D is the depreciation amount P is the purchase amount R is the percentage rate of depreciation per annum n is the number of years after the purchase.

Small businesses can deduct the cost of buying and using business assets by depreciating these assets over several years. Im dealing with a 100 business use passenger vehicle truck that would take 14 years to depreciate because of the rules under HY 200DBSo we disposed of it in May of year 6. If you take a section 179 deduction explained in chapter 8 under Depreciation for an asset and before the end of the assets recovery period the percentage of business use drops to 50 or less you must recapture part of the section 179 deduction.

This calculator for a car depreciation is also estimated the first year and the total vehicle depreciation. The Car Depreciation Calculator uses the following formulae. Supports Qualified property vehicle maximums 100 bonus safe harbor rules.

Adheres to IRS Pub. The simplified small business depreciation rules include. Stick to the following steps to calculate car depreciation expense.

Calculate Car Depreciation With Car Depreciation Calculator.

Car Depreciation Calculator Calculate Straightline Reducing Balance Automobile Depreciation Rates Vehicle Values

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

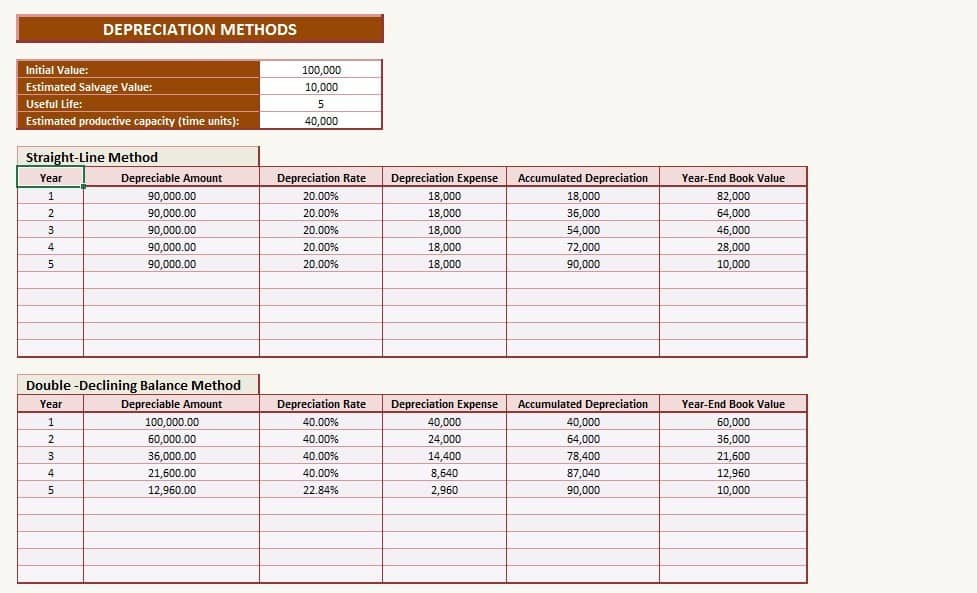

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Calculate Depreciation Expense

Macrs Depreciation Calculator With Formula Nerd Counter

.png)

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

Free Macrs Depreciation Calculator For Excel

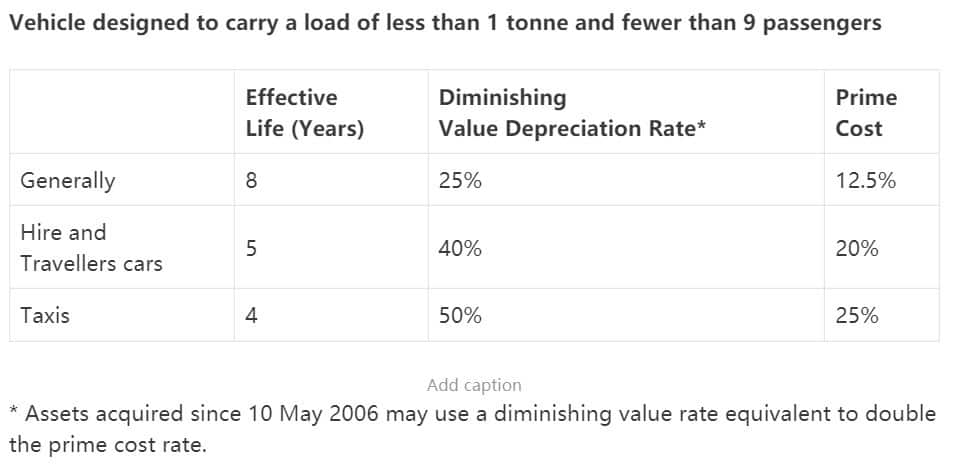

Depreciation Of Vehicles Atotaxrates Info

How To Calculate Depreciation Expense For Business

Car Depreciation Calculator

Depreciation Of Vehicles Atotaxrates Info

Depreciation Schedule Template For Straight Line And Declining Balance

Annual Depreciation Of A New Car Find The Future Value Youtube

Macrs Depreciation Calculator Irs Publication 946

Depreciation Calculator

Depreciation Formula Calculate Depreciation Expense

Depreciation Calculator Depreciation Of An Asset Car Property